Imagine waking up one morning to find that the value of your savings has plummeted overnight, stores are struggling to stock essentials, and economic news is filled with words like “recession” and “crisis.” It’s a scenario that many of us prefer not to think about, but the reality is that financial collapses have happened before and can happen again.

Key Takeaways:

- A financial collapse occurs when a country’s economic system fails, leading to widespread financial instability.

- The world’s wealthiest individuals often take extensive measures to prepare for potential financial collapses, leveraging their resources to build robust safety nets.

- Understanding your current financial situation is the first step towards preparing for a potential financial collapse.

- Creating a sustainable lifestyle is an essential step in building financial resilience and preparing for potential economic disruptions.

- Developing practical skills is essential for increasing your self-sufficiency and resilience in the face of financial collapse.

This article will guide you through practical steps to build financial resilience, helping you to safeguard your wealth, maintain your standard of living, and confidently navigate through potential economic turmoil. By taking proactive measures now, you can face the future with peace of mind, no matter what comes your way.

What Is a Financial Collapse?

A financial collapse occurs when a country’s economic system fails, leading to widespread financial instability. This can happen for various reasons, such as severe market crashes, banking system failures, or governmental financial mismanagement.

When a financial collapse happens, it typically results in a significant loss of wealth, increased unemployment rates, and a dramatic decline in the standard of living for the affected population. Businesses may shut down, and the availability of essential goods and services can be severely disrupted.

Historically, financial collapses have had devastating effects on societies. Examples include the Great Depression of the 1930s and the 2008 global financial crisis. In such events, the value of currency may plummet, and access to credit can become extremely limited, further exacerbating the economic downturn.

Signs of an Impending Financial Collapse

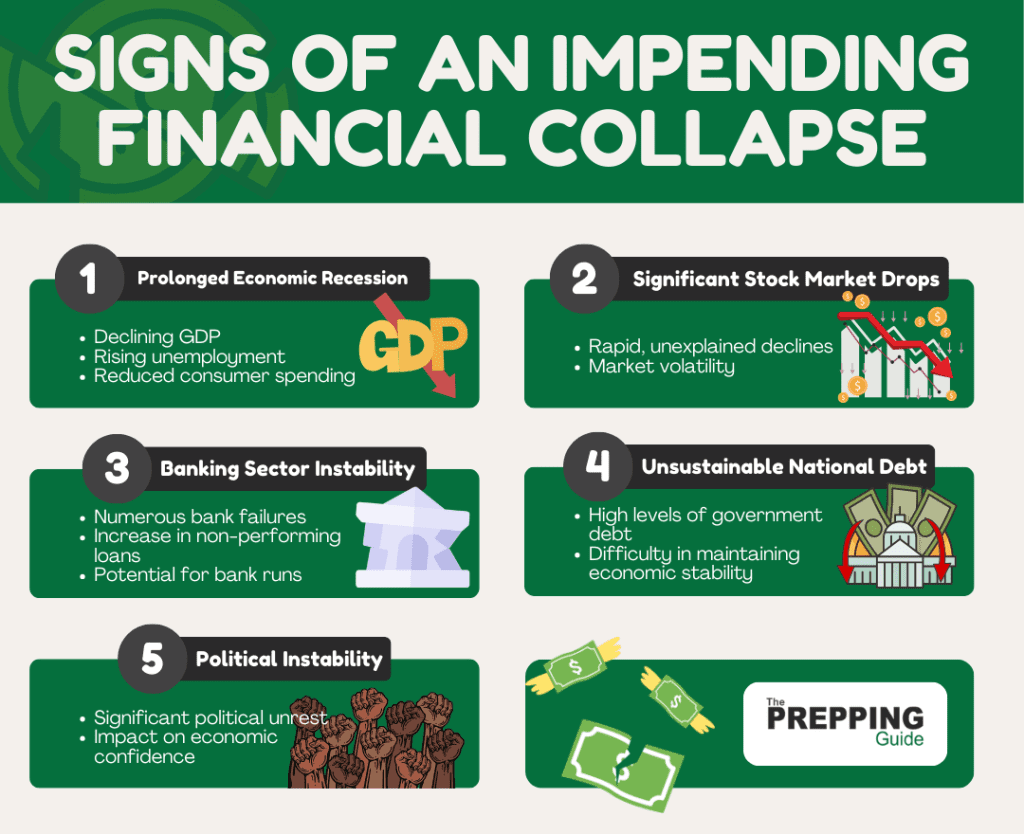

Recognizing the signs of an impending financial collapse can help you take proactive steps to safeguard your finances. One major indicator is a prolonged economic recession, characterized by declining GDP, rising unemployment, and reduced consumer spending. When these factors persist, they signal underlying issues within the economy that could lead to a collapse. Significant drops in stock markets, especially if they happen rapidly and without clear reasons, often precede financial crises.

Another critical sign is instability in the banking sector, such as numerous bank failures or a sharp increase in non-performing loans. If banks begin to struggle, it can lead to a loss of confidence among consumers and investors, resulting in bank runs and tighter credit. Additionally, unsustainable levels of national debt and significant political instability can also foreshadow a financial collapse, as governments may struggle to maintain economic stability under such conditions.

What are the World’s Richest Preppers Doing?

The world’s wealthiest people take serious steps to prepare for financial collapses, using their resources to create strong safety nets. They invest in various assets like real estate and precious metals, which hold value well during economic downturns. They also keep some wealth in stable currencies and foreign assets to reduce local economic risks.

Beyond finances, wealthy preppers focus on personal safety and self-sufficiency. This includes owning remote, secure properties stocked with supplies for long-term survival. They invest in advanced security systems, stockpile essential goods, and even build underground bunkers for extreme situations.

For example, a Wall Street executive mentioned in the New Yorker keeps a helicopter ready to fly him to his underground bunker, equipped with a self-sufficient garden, power source, and food and water supply. Similarly, Tim Chang, managing director at Mayfield Fund, has bug-out bags for his family and several established bug-out locations in regional areas.

Assessing Your Current Financial Situation

Understanding your current financial situation is the first step towards preparing for a potential financial collapse. This involves evaluating your assets and liabilities, reviewing your income and expenses, and identifying any financial vulnerabilities you may have.

Evaluating Your Assets and Liabilities

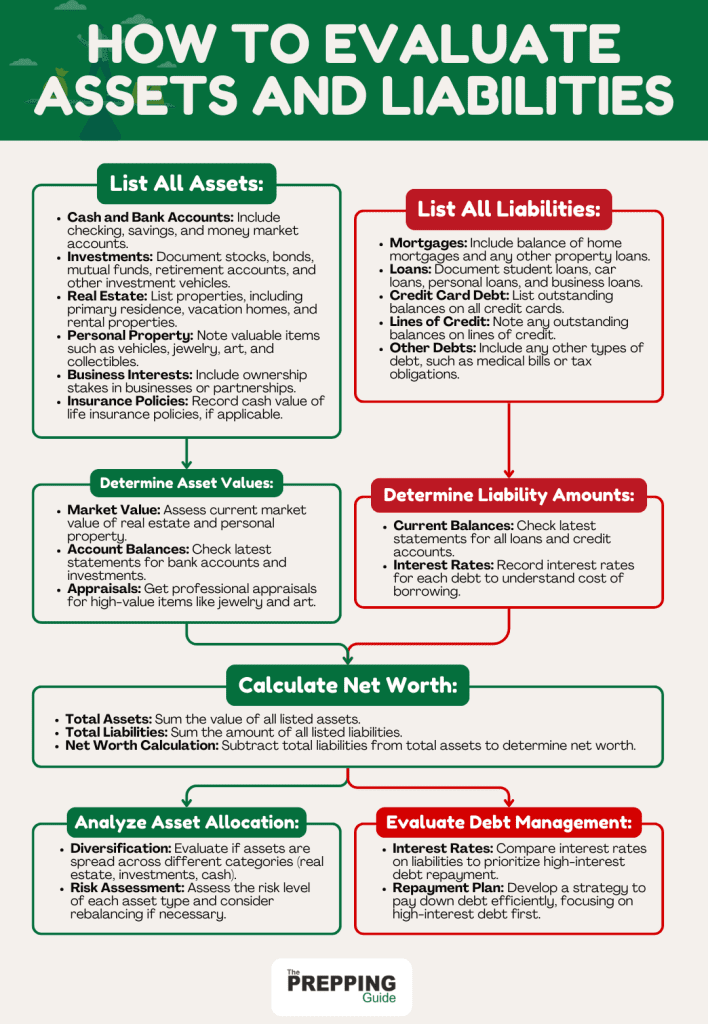

Evaluating your assets and liabilities helps you understand your net worth, which is the total value of what you own minus what you owe. Start by listing all your assets, including cash, savings accounts, investments, real estate, and any valuable possessions. Then, list your liabilities, such as mortgages, credit card debts, student loans, and other personal loans.

You can use this checklist as a guide:

Reviewing Your Income and Expenses

Reviewing your income and expenses is essential to ensure you are living within your means and saving adequately for the future. Begin by tracking all your income sources, including salary, bonuses, freelance work, and any other earnings. Then, list all your monthly expenses, such as rent or mortgage payments, utilities, groceries, transportation, and discretionary spending. This exercise helps identify unnecessary expenses and areas where you can save more money. Creating a budget based on this review will help you manage your finances more effectively and prepare for any financial challenges that may arise.

Identifying Financial Vulnerabilities

Identifying financial vulnerabilities involves looking for weaknesses in your financial situation that could be problematic in a financial collapse. This could include high levels of debt, lack of savings, or reliance on a single income source. Assessing these vulnerabilities allows you to address them proactively and strengthen your financial resilience.

For instance, if you discover that you have a high amount of credit card debt, you can create a plan to pay it down more aggressively. If your savings are insufficient, you can look for ways to increase your savings rate.

Building a Financial Safety Net

Building a financial safety net is essential for protecting yourself against the uncertainties of a financial collapse. This includes establishing an emergency fund, diversifying your income sources, reducing debt, and investing in tangible assets.

Establishing an Emergency Fund: A Step-by-Step Checklist

An emergency fund is a crucial component of a financial safety net, providing a financial cushion in case of unexpected expenses or income loss. Here’s a practical checklist to help you build and maintain this crucial safety net:

Step 1: Determine Your Target Fund Size

Assess your monthly expenses by reviewing bills and spending habits. Calculate the total for necessities like housing, utilities, groceries, insurance, and healthcare. Aim to save enough to cover three to six months of these expenses, providing a substantial safety net in case of sudden income loss or unforeseen expenses.

Step 2: Set Up a Dedicated Savings Account

Opt for a high-yield savings account that combines ease of access with a competitive interest rate, maximizing the growth of your funds while keeping them liquid. Ensure the account is separate from your checking to avoid dipping into these funds for everyday expenses.

Step 3: Create a Monthly Savings Plan

Analyze your budget to determine how much money you can realistically set aside each month. Factor in your regular income and expenses, and identify potential areas for cost-cutting that could increase your savings rate. Even modest, consistent contributions can grow significantly over time due to compound interest.

Step 4: Automate Your Savings

Automating your savings is a strategic way to ensure you consistently contribute to your emergency fund without needing to remember each month. Set up an automatic transfer from your main banking account to your emergency fund immediately after you receive your paycheck. This “pay yourself first” approach helps to prioritize saving over spending.

Step 5: Prioritize Contributions

Reevaluate your discretionary spending, such as dining out, entertainment, and other non-essentials. Prioritizing your emergency fund over these expenditures can accelerate its growth. Treat your contributions to this fund as non-negotiable, similar to paying a bill.

Step 6: Monitor and Adjust

Regularly review your emergency fund and financial situation every few months or whenever you experience a significant financial change (like a raise or new job). If your living costs or financial responsibilities increase, adjust your savings goal to ensure your fund remains adequate to cover the increased expenses.

Diversifying Income Sources

Diversifying your income sources can provide additional financial stability and reduce the risk of relying on a single income stream. Consider taking on freelance work, starting a side business, or investing in passive income opportunities such as rental properties or dividend-paying stocks. These additional income streams can help supplement your primary income and provide financial support if you lose your job or face reduced work hours.

Reducing Debt and Avoiding New Debt

Reducing debt is critical for financial resilience, as high levels of debt can become unmanageable during a financial collapse. Focus on paying down high-interest debt first, such as credit card balances, to reduce the amount of interest you pay over time. Consider consolidating loans or negotiating with creditors to lower interest rates or payment amounts. Avoid taking on new debt unless absolutely necessary. Living within your means and using credit responsibly can help you stay out of financial trouble.

Investing in Tangible Assets

Investing in tangible assets, such as real estate, precious metals, or commodities, can provide a hedge against financial instability. These assets often retain value better than paper investments like stocks or bonds during economic downturns. Real estate, for example, can provide rental income and potential appreciation over time. Precious metals like gold and silver are also considered safe-haven assets that can protect your wealth during financial crises.

Creating a Sustainable Lifestyle

Creating a sustainable lifestyle is an essential step in building financial resilience and preparing for potential economic disruptions. A sustainable lifestyle involves making choices that reduce your reliance on external systems and increase your self-sufficiency. This can include growing your own food, using renewable energy sources, and reducing waste.

Living sustainably also means being mindful of your consumption habits and focusing on quality over quantity. This can involve purchasing durable goods that last longer, repairing items instead of replacing them, and minimizing unnecessary purchases.

Preparing for Short-Term Disruptions

Preparing for short-term disruptions involves having a plan in place for immediate emergencies that can impact your daily life. To be physically prepared, start by assembling an emergency kit with non-perishable food, bottled water (one gallon per person per day for three days), essential medications, and a first aid kit. Additionally, include a flashlight, multi-tool, blankets, hygiene products, and a manual can opener. Store this kit in an easily accessible location.

Next, create a family emergency plan by designating safe meeting spots and compiling a list of emergency contacts. Ensure everyone knows how to reach these contacts. Finally, regularly check and update your supplies to ensure they are not expired and are in good condition.

Ensuring Financial Preparedness

1. Set Up a Small Emergency Fund

Savings Goal: Aim to accumulate at least one month’s worth of essential expenses (rent/mortgage, utilities, groceries, transportation) in a separate, easily accessible savings account.

Monthly Contributions: Determine a fixed amount to save each month. Even small contributions can add up over time. Treat this savings as a priority, similar to paying a bill.

2. Maintain Quick Access to Cash

Cash on Hand: Keep a small amount of cash (enough for a few days of expenses) at home in a secure place, like a safe, to use in case electronic payment systems are down.

Bank Accounts: Ensure you have access to online banking and mobile apps to manage your accounts. Consider accounts with features that allow for quick withdrawals and transfers.

3. Review and Adjust Financial Plans

Expense Management: Regularly review your budget to identify and cut non-essential expenses. Focus on necessities and consider how you can reduce spending temporarily during a disruption.

Debt Management: Have a plan for managing debt payments if your income is reduced. Contact creditors to discuss potential deferment or reduction options during emergencies.

4. Stay Informed and Adaptable

Current Events: Stay updated on potential threats or disruptions in your area by following local news and weather reports. Sign up for emergency alerts from local authorities.

Flexible Plans: Be prepared to adjust your plans based on evolving circumstances. Regularly review and revise your emergency and financial plans to address new risks and opportunities.

Protecting Your Finances

To protect your finances, diversify your assets by moving savings to stable currencies like the US Dollar or Swiss Franc, and invest in government or high-quality corporate bonds for predictable returns.

Invest in precious metals like gold and silver to hedge against inflation and economic instability. These metals maintain value during financial crises and can balance risks in your investment portfolio.

Explore cryptocurrencies such as Bitcoin and Ethereum for potential high returns, but start small and increase exposure gradually after thorough research. Don’t forget to keep some cash on hand for emergencies when electronic payment systems fail. Aim to cover at least a week’s worth of expenses.

Stay informed and adaptable by monitoring economic indicators like unemployment and inflation rates, stock market performance, and consumer confidence. Use reliable sources to track these indicators and adjust your financial strategies proactively.

Following Trusted Financial Experts

Following trusted financial experts can provide valuable insights and guidance during uncertain times. Experts such as economists, financial analysts, and experienced investors offer analyses and recommendations based on current market conditions. By listening to their advice, you can make more informed decisions about managing your finances.

Here are some top financial experts to consider:

- Christine Lagarde: President of the European Central Bank and former Managing Director of the IMF, known for her deep insights into global economics.

- Andrew Ross Sorkin: A financial columnist for The New York Times and co-anchor of CNBC’s “Squawk Box,” offering detailed analyses of market trends.

- Kevin O’Leary: Investor and “Shark Tank” personality, providing insights into entrepreneurship and investment strategies.

- Gretchen Morgenson: Senior financial reporter at NBC News, known for her investigative journalism on financial conflicts of interest.

- Stephanie Flanders: Head of Economics and Politics at Bloomberg, offering expert commentary on economic policies and market dynamics.

- Scott Trench: CEO of BiggerPockets, providing comprehensive resources and advice for real estate investors.

- Larysa Melnychuk: Founder of FP&A Trends, sharing best practices and corporate financial advice.

- Paul Barnhurst: Known as “The FP&A Guy,” he provides daily insights and practical resources for finance professionals on LinkedIn.

Updating Your Plan Regularly

Updating your financial plan regularly is crucial for maintaining resilience in a changing economic environment. Review your plan at least annually or whenever significant changes occur in your financial situation or the broader economy. Assess your savings, investments, and emergency fund to ensure they align with your current needs and goals. Make adjustments as necessary, such as reallocating investments, increasing your emergency fund, or cutting unnecessary expenses.

Stay Ready for Anything

In a world of economic uncertainties, being prepared is more important than ever. By assessing your financial situation, building a safety net, creating a sustainable lifestyle, developing practical skills, and staying informed, you can enhance your financial resilience. Remember, preparation is key to navigating financial collapse with confidence and security.

FAQs

What should I do if I lose my job during a financial collapse?

If you lose your job during a financial collapse, prioritize cutting unnecessary expenses and use your emergency fund to cover essential costs. Look for temporary work or freelance opportunities to generate income and consider reaching out to your network for job leads. Updating your resume and enhancing your skills can also improve your chances of finding new employment.

How can I protect my retirement savings during a financial crisis?

To protect your retirement savings, diversify your investments across different asset classes such as stocks, bonds, real estate, and precious metals. Avoid making panic-driven decisions and focus on long-term goals. Consulting a financial advisor can provide personalized strategies to safeguard your retirement funds during turbulent times.

What are the best ways to secure my home and family?

Securing your home and family involves both physical and financial preparedness. Ensure you have a safe and secure living environment by reinforcing doors and windows, installing security systems, and having emergency supplies on hand. Financially, maintain an emergency fund and keep some cash at home for immediate needs. Stay informed about local conditions and have a communication plan in place with your family.

How do I start preparing if I have limited financial resources?

If you have limited financial resources, start by creating a budget to manage your expenses and prioritize saving a small emergency fund. Focus on acquiring essential skills such as basic first aid and gardening, which can provide significant benefits with minimal costs. Utilize free resources like community classes, online tutorials, and public libraries to gain knowledge and skills for preparation.

Have you noticed that what was mentioned in the Lombardi letter is happening now in the U.S.A.?

You also ask” What are the rich preppers doing?” Especially since the TOP 1% GROUP JUST GOT A MASSIVE TAX CUT. Most preppers probably did not benefit form it.

Other than the Great depression; when has the U.S. recent total economic melt down?

The last recession was caused by people spending money foolishly( If you’re making only $90,000 a year; why do you want to own a $50,000 car? or a $1,000,000 house?). Banks were also stupid about who they loaned money to.

Debt Except for your home you should not have any. If you can’t buy it cash you don’t need it.

Food Number one thing to store up. In Venezuela food was the best barter item. In a real collapse cash will only be king for a short while till inflation eats it up.

Save money. Easiest way to save money is to not spend it. No vacation. ( stay home) no going out to eat. Cut cable, cut your cell phone, stop smoking. Figure out what the difference is between needs and wants and cut out the wants. Do this for a year and you will be amazed how much you have saved. You don’t have to do it forever just long enough to fill that account

Silver and gold coins, the best.