In today’s unpredictable world, the concept of preparedness has evolved from a niche hobby to a crucial aspect of everyday life. Whether it’s natural disasters, economic uncertainties, or unexpected personal challenges, being ready for the unexpected is more important than ever. Learning how to start prepping is about more than just gathering supplies; it’s about fostering a mindset of resilience and self-sufficiency.

Key Takeaways

- To start prepping involves more than just gathering supplies; it encompasses gaining knowledge, developing essential skills, and creating a mindset of resilience and self-sufficiency to handle various emergencies.

- Conducting a personal risk assessment is crucial for prioritizing your prepping efforts. By evaluating the specific threats you face based on your location and lifestyle, you can tailor your preparedness plan to address the most likely risks effectively.

- Building and maintaining a well-stocked emergency kit is vital. Ensure it includes water, non-perishable food, first aid supplies, tools, hygiene products, clothing, important documents, an emergency radio, cash, and personal items.

- Proper storage techniques for long-term food and water are essential for sustained preparedness.

This guide will walk you through the essentials on how to start your prepping journey, offering practical tips and insights to help you protect yourself and your loved ones..

What Is Prepping?

Prepping, short for “preparing,” derives from the verb “to prepare.” At its core, prepping is the practice of actively preparing for potential future emergencies or disruptions, whether natural or man-made. It goes beyond simply gathering supplies and involves a holistic approach that encompasses knowledge acquisition, skill development, and resource management.

Think of prepping as building a safety net. This net includes having a stockpile of necessities like food and water, creating emergency plans for different scenarios, and cultivating a mindset that prioritizes readiness and resilience.

Preppers, the individuals who engage in prepping, aim to create a comprehensive safety net that ensures their well-being and resilience in the face of adversity.

Types of Prepping

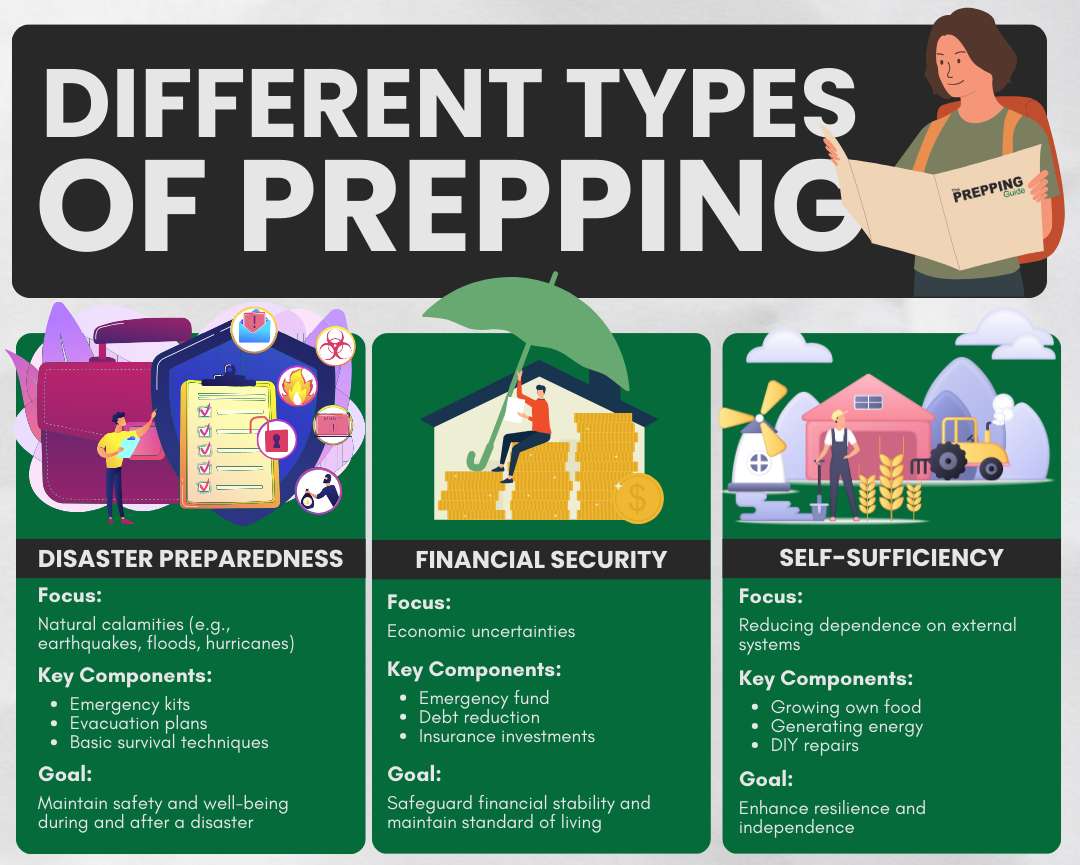

There are many different ways to prep, and the best approach for you will depend on your individual circumstances and risk tolerance. Here are some of the most common types of prepping to start:

Disaster preparedness: It focuses on being ready for natural calamities like earthquakes, floods, or hurricanes. This involves having emergency kits, evacuation plans, and knowledge of basic survival techniques. It’s about ensuring you can maintain safety and well-being during and after a disaster.

Financial security: It’s about safeguarding your financial stability by having an emergency fund, reducing debt, and investing in insurance. This type of prepping ensures you can navigate economic uncertainties without compromising your standard of living.

Self-sufficiency: This emphasizes skills and practices that reduce dependence on external systems, such as growing your own food, generating energy, or learning DIY repairs. Each type of prepping complements the others, creating a robust strategy for overall resilience.

For a better understanding, here’s a table highlighting the different types of prepping:

Conducting A Personal Risk Assessment

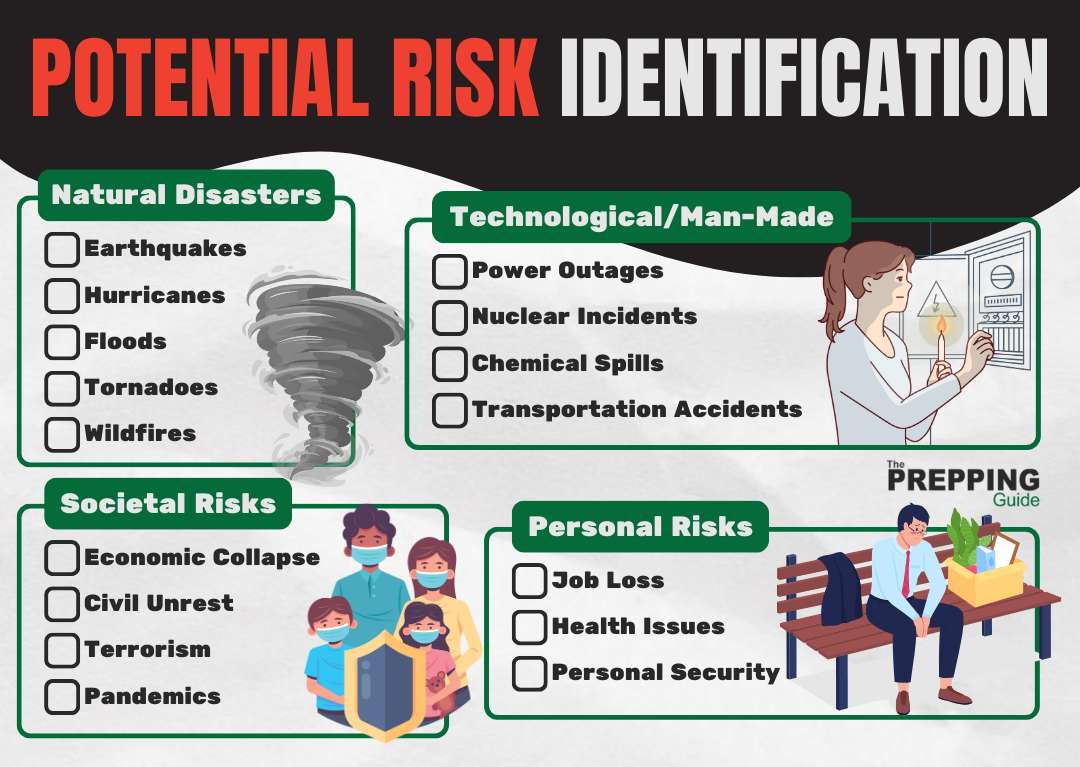

Conducting a personal risk assessment involves evaluating the specific threats you may face based on your geographical location and lifestyle. By identifying potential threats, you can prioritize your prepping efforts. This helps you focus on supplies and resources that address the most likely risks in your area.

Here are some of the risks that you may need to include in your assessment:

In addition to external threats, assess your personal and family needs, such as medical conditions, dietary restrictions, or special requirements for children and pets. By thoroughly understanding these factors, you can create a more effective and comprehensive prepping strategy. This proactive approach ensures you’re ready for the most relevant and probable scenarios.

Ensuring Long-Term Food and Water

Ensuring you have reliable food and water storage is a cornerstone of effective prepping. Here’s how to make sure your supplies are ready for the long haul.

How to Store Water for Long-Term Use

Proper water storage is crucial for long-term preparedness. Here are effective ways to store water for extended periods:

- Use Food-Grade Containers: Store water in containers labeled as safe for food and water storage to avoid contamination. Opt for materials like polyethylene or glass, which do not leach chemicals. Ensure the containers are tightly sealed to prevent leaks and contamination.

- Add Preservatives: Use water preservatives like sodium hypochlorite or unscented household bleach to extend the shelf life of stored water. Typically, adding 1/8 teaspoon of bleach per gallon of water can keep it safe for long-term storage. Always follow the manufacturer’s guidelines for the correct dosage.

- Rotate Regularly: Change stored water every six months to ensure freshness and safety. Mark the containers with the date they were filled to keep track of their age. Use a first-in, first-out (FIFO) system to rotate water supplies efficiently.

- Keep in a Cool, Dark Place: Store water in a location away from sunlight and heat to prevent algae growth and degradation. Specifically, ideal storage areas include basements, closets, or insulated garages, where temperature fluctuations are minimal.

Food Storage Options: Canned Goods, Dry Bulk, MREs

Diverse food storage options help ensure a balanced diet during emergencies. Here’s a breakdown of key options:

- Canned Goods: These are convenient and have a long shelf life. For instance, choose a variety of vegetables, fruits, and proteins to ensure nutritional balance. Furthermore, canned foods are typically shelf-stable for up to five years or more if stored properly. However, consider low-sodium and no-added-sugar options to maintain a healthier diet.

- Dry Bulk Items: Store grains, beans, and pasta in airtight containers to keep them dry and safe from pests. Use Mylar bags with oxygen absorbers for an added layer of protection against moisture and insects. These items can last for several years if stored in a cool, dry environment, making them ideal for long-term storage.

- Meal-Ready-to-Eat (MREs): These military-style meals are designed for long shelf life and ease of preparation, making them ideal for emergency kits. MREs include a main course, side dish, dessert, and a heating element, providing a complete meal solution. They are compact, lightweight, and can last up to five years, making them perfect for bug-out bags or quick deployment.

Use the “First In, First Out” system to stay fresh. Put new supplies in the back and use older ones first. This avoids waste and keeps your kit stocked with the freshest items. Clearly mark everything with the date so you know what to use first. It helps keep your inventory organized and helps you maintain a fresh supply.

Building Your First Emergency Kit

Creating your first emergency kit is a crucial step in your prepping journey. It’s all about assembling essential items that will support you during an emergency, ensuring you’re ready for any situation. Keep in mind that building a well-stocked emergency kit doesn’t have to be expensive. The key is to start small and gradually add items over time.

To ensure you’re well-prepared, here’s a list of essential items every emergency kit should include:

- Water: Aim for at least one gallon per person per day for drinking and sanitation. Consider water purification tablets or a portable filter.

- Non-Perishable Food: Stock up on items with a long shelf life, like canned goods, dried fruits, and protein bars.

- First Aid Kit: Include bandages, antiseptics, pain relievers, and any prescription medications your family needs.

- Tools and Supplies: A multi-tool, duct tape, a flashlight with extra batteries, and a manual can opener are essential for handling various tasks.

- Hygiene Products: Pack toiletries such as soap, hand sanitizer, sanitary napkins, and moist towelettes.

- Clothing and Bedding: Extra clothing, sturdy shoes, and blankets or sleeping bags to keep warm and dry.

- Important Documents: Keep copies of identification, insurance policies, and emergency contacts in a waterproof container.

- Emergency Radio: A battery-powered or hand-crank radio to stay informed about emergency updates.

- Cash: Small bills and coins can be invaluable if ATMs and card systems are down.

- Personal Items: Don’t forget items like glasses, contact lens solution, and any specific needs for babies or pets.

Don’t just build your emergency kit, keep it up-to-date! Regularly check expiration dates on food, water, and medications. Store it in a cool, dry, and accessible place. Think about the seasons and add or remove items like sunscreen or blankets. Make sure flashlights and radios work by testing and replacing batteries. Finally, practice using your kit with your family so everyone is prepared in an emergency.

Establishing Financial Preparedness

Financial security is the cornerstone of effective prepping. It empowers you to not only acquire essential supplies and safety measures but also manage emergencies without financial burden. This stability ensures you’re prepared to tackle unexpected costs like medical bills, repairs, or income loss during a crisis.

With your finances in order, you can focus on critical survival tasks without the added stress of financial worries. Furthermore, a strong financial foundation allows for proactive prepping. You can invest in high-quality supplies, training, and even a secure location for emergencies.

How to Build an Emergency Fund for Preppers

Building an emergency fund is a fundamental step in financial preparedness. Start by setting a realistic savings goal, ideally aiming for three to six months’ worth of living expenses. This fund acts as a financial cushion, providing immediate access to cash during emergencies without relying on credit or loans.

To build this fund, allocate a portion of your income each month specifically for emergency savings, and consider automating transfers to make saving effortless. In addition to regular savings, explore ways to increase your fund through side gigs, selling unused items, or reducing non-essential expenses. Keep your emergency fund in a high-yield savings account or other liquid assets that are easily accessible.

Insurance and Other Protective Financial Measures

Insurance is a critical component of financial preparedness, offering protection against significant financial losses. Consider policies that cover health, property, and life insurance to safeguard against various risks.

- Health insurance ensures you have access to medical care during emergencies, while property insurance protects your home and belongings from damage or loss due to natural disasters or theft.

- Life insurance provides financial support to your loved ones in the event of your untimely death, ensuring their stability.

Beyond insurance, explore other protective financial measures such as diversifying your investments, maintaining a low debt-to-income ratio, and having a contingency plan for job loss or economic downturns. Diversified investments can provide additional income streams and financial security, while minimizing debt reduces financial burden during crises.

Learning Essential Skills

Mastering essential skills is a cornerstone of prepping, equipping you with the knowledge and abilities to handle various challenges.

To be well-prepared, focus on developing these essential skills:

- First Aid: Understanding basic first aid is crucial for managing injuries and medical emergencies. Learn how to perform CPR, treat wounds, and recognize symptoms of common ailments. Consider taking a certified first aid course to enhance your knowledge and confidence in handling medical situations.

- Survival Skills: Proficiency in survival skills like fire-starting, shelter-building, and navigation is vital for handling outdoor emergencies. Practice these skills regularly in various conditions to build muscle memory and confidence. Joining a survival skills workshop or engaging in outdoor activities can help refine these abilities.

- Mechanical Repairs: Basic mechanical skills enable you to fix essential equipment and vehicles during emergencies. Learn how to perform simple repairs on items like generators, water pumps, and vehicles. Having a toolkit and knowing how to use it effectively can make a significant difference in maintaining functionality during crises.

Continuous learning is key to maintaining and enhancing your prepping skills. To achieve this, regularly practice the skills you’ve acquired to keep them fresh and effective. Furthermore, engage in activities like camping, hiking, and DIY projects to apply your skills in real-world scenarios. As a result, this hands-on experience helps reinforce your knowledge and build confidence in your abilities.

To further your knowledge, explore these resources:

- Online Courses: Platforms like Udemy and Coursera offer a variety of courses on first aid, survival skills, and mechanical repairs. For example, Udemy’s “Wilderness Survival Skills” provides comprehensive training in essential outdoor skills.

- Books: Consider reading books like “The SAS Survival Handbook” by John ‘Lofty’ Wiseman, which covers a wide range of survival techniques. Another great resource is “Emergency War Surgery” by the U.S. Department of the Army, which offers detailed medical guidance for emergencies.

- Workshops and Local Classes: Look for local workshops or classes on first aid, wilderness survival, or mechanical repairs. Organizations like the American Red Cross offer certified first aid and CPR courses, while community colleges often have classes on basic mechanical skills.

- Prepper Forums and Groups: Joining forums allows you to connect with experienced preppers, share knowledge, and stay updated on the latest tips and techniques.

- YouTube Channels: There are prepper channels that provide practical tutorials and demonstrations of various prepping skills.

Developing a Communication Plan

A communication plan is crucial in emergencies. When phones and internet are down, having a backup plan with alternative methods and meeting points lets you stay informed, connected to loved ones, and able to make informed decisions.

When conventional communication systems fail, these tools can keep you connected:

- Satellite Phones: Satellite phones are reliable for long-distance communication, even when cell towers are down. They connect directly to satellites, providing coverage in remote and disaster-affected areas. While more expensive, they are invaluable for ensuring you can reach emergency services or family members during severe disruptions.

- Two-Way Radios: Two-way radios, such as walkie-talkies, are excellent for short-range communication. They are easy to use, do not rely on external infrastructure, and are ideal for coordinating with family or group members within a few miles. Invest in models with a long battery life and weather resistance for optimal performance.

- Ham Radios: Ham radios, or amateur radios, offer a broader range of communication and can connect with other radio operators worldwide. They require a license to operate but provide a robust communication network during emergencies. Ham radios are versatile and can be a critical component of your emergency communication plan.

- Emergency Radios: Emergency radios can receive weather updates, news broadcasts, and emergency alerts. Look for models with multiple power options, such as hand-crank, solar, or battery, to ensure they remain operational during power outages.

Prioritizing Shelter and Safety

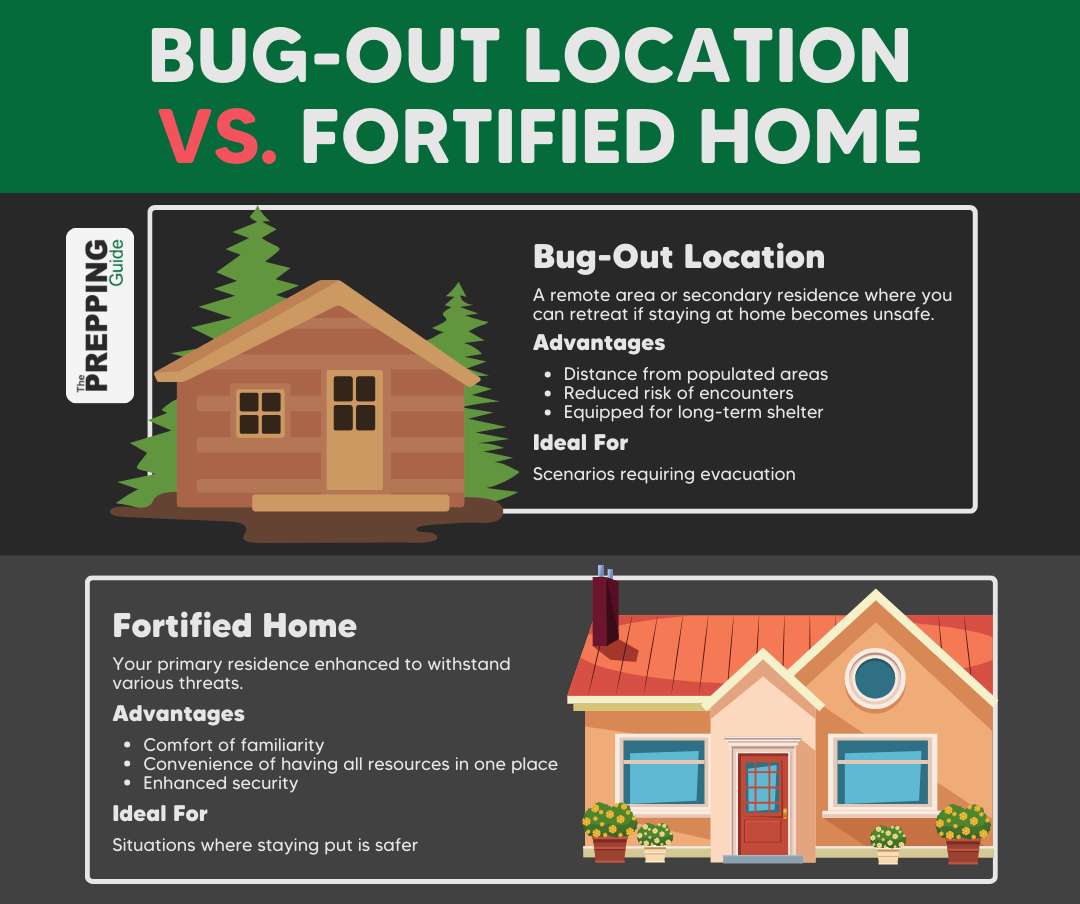

Choosing between a bug-out location and a fortified home depends on your specific circumstances and the nature of the emergency you’re preparing for.

A bug-out location is typically a remote area or secondary residence where you can retreat if staying at home becomes unsafe. These locations should be well-stocked, easily accessible, and equipped to provide long-term shelter. The advantage of a bug-out location is its potential distance from populated areas, reducing the risk of encounters with others during widespread crises.

On the other hand, a fortified home is your primary residence that’s been enhanced to withstand various threats. This includes reinforcing doors and windows, installing security systems, and maintaining a sufficient stockpile of supplies. Fortifying your home is ideal for scenarios where staying put is safer than evacuating. It offers the comfort of familiarity and the convenience of having all your resources in one place.

The choice between a bug-out location and a fortified home should be based on a thorough risk assessment and your specific preparedness plan. Here’s a quick comparison of the two:

Best Practices for Securing Your Home or Bug-Out Location

Securing your home or bug-out location involves several best practices to enhance safety and preparedness. To begin, here’s a list of essential steps to follow:

- Reinforce Entry Points: Strengthen doors and windows with sturdy locks, security bars, and shatter-resistant films to prevent unauthorized entry.

- Install Security Systems: Use alarm systems, motion detectors, and surveillance cameras to monitor your property and deter potential intruders.

- Maintain Clear Perimeters: Keep the area around your home or bug-out location clear of obstructions to improve visibility and reduce hiding spots for intruders.

- Create Safe Rooms: Designate and fortify a specific room in your home as a safe room where you can retreat during an immediate threat.

- Stock Adequate Supplies: Ensure your shelter has a well-stocked supply of food, water, medical kits, and essential tools for at least two weeks.

- Establish Emergency Exits: Plan and maintain clear evacuation routes from your home or bug-out location in case you need to leave quickly.

- Conduct Regular Drills: Practice emergency scenarios with your family to ensure everyone knows their roles and the location of essential supplies.

Prioritizing Medical Preparedness

Being prepared medically is crucial for handling health-related emergencies effectively. Having the right supplies and plans in place can make a significant difference in outcomes during crises.

To be well-prepared, here’s a list of essential first aid and medical supplies every prepper should have:

- Basic First Aid Kit: Include adhesive bandages, gauze pads, antiseptic wipes, and adhesive tape for treating minor injuries.

- Medications: Stockpile essential prescription medications, pain relievers, antihistamines, and antacids.

- Wound Care Supplies: Have antiseptic solutions, antibiotic ointments, and sterile dressings for treating wounds and preventing infections.

- Tools and Equipment: Include a thermometer, tweezers, scissors, and a splint kit for various medical needs.

- Personal Protective Equipment (PPE): Stock N95 masks, disposable gloves, and eye protection to safeguard against contaminants.

- CPR Mask: Keep a CPR mask or face shield for safe administration of cardiopulmonary resuscitation.

- Emergency Blankets: Use space blankets to prevent hypothermia and maintain body heat.

- Burn Treatment Supplies: Include burn dressings, aloe vera gel, and sterile water for treating burns.

- Eye Care Supplies: Stock eye wash solution and eye pads to manage eye injuries.

- Manuals and Guides: Have a comprehensive first aid manual to guide you through medical procedures.

For those who rely on long-term medications, prepping for emergencies requires extra planning. The first step is to create a detailed list of all your medications, including dosages and how often you take them. Discussing this list with your doctor can help you explore the possibility of obtaining extra prescriptions to maintain a sufficient supply in case of disruptions.

Proper storage is also crucial. Medications should be kept in a cool, dry place away from direct sunlight to preserve their efficacy. In addition to your primary medications, consider alternative and backup options. Herbal remedies or over-the-counter substitutes might be viable for temporary use in an emergency.

Remember to regularly review and update your medication supply. Rotate your stock to ensure all medications are within their expiration dates. By following these steps, you can ensure you have the medications you need to stay healthy during an emergency.

Building Community and Expanding Your Network

Joining local prepper networks and online forums connects you with like-minded individuals who share valuable insights and experiences. Local prepper groups often organize meetings, workshops, and training sessions, providing opportunities to learn new skills and discuss strategies. As mentioned earlier, online forums offer a platform to exchange ideas, ask questions, and share success stories with a broader audience.

Community groups play a vital role in enhancing information sharing and coordination during emergencies. These groups often include members with diverse skills and knowledge, providing a broad range of resources and expertise.

Skill-sharing within your community is an excellent way to strengthen your prepping plan. By collaborating with others, you can exchange expertise and learn new skills that enhance your overall preparedness. For instance, you might share your knowledge of first aid in exchange for learning gardening or mechanical repairs from a neighbor. This exchange of skills not only broadens your capabilities but also fosters a sense of community and mutual support.

Conclusion: Embracing Preparedness

Embracing preparedness is about taking proactive steps to ensure you and your loved ones are ready for any challenges that may come your way. It’s not just about collecting supplies but also about cultivating a mindset of resilience and self-sufficiency.

Understanding the basics of prepping is crucial. By assessing your needs, you can identify potential risks and plan accordingly. Next, building comprehensive emergency kits ensures that you have the necessary supplies during a crisis. Enhancing your skills, such as first aid and basic survival techniques, increases your ability to handle emergencies effectively. Furthermore, establishing communication plans and fostering community connections provide vital support networks during difficult times.

In summary, by taking these steps—understanding the basics of prepping, assessing your needs, building emergency kits, and enhancing your skills—you lay a solid foundation for facing emergencies with confidence and calm.

FAQs

Is prepping necessary?

Prepping is necessary for anyone who wants to ensure their safety and well-being in the face of unexpected events. Whether it’s a natural disaster, economic crisis, or personal emergency, being prepared can significantly reduce the impact on you and your family.

What is the first rule of prepping?

The first rule of prepping is to start with a plan. Undoubtedly, having a well-thought-out plan is crucial as it guides all your preparedness efforts, from gathering supplies to learning essential skills. Specifically, this plan should include risk assessments, resource lists, and emergency procedures tailored to your specific needs and circumstances.

What foods are good for prepping?

Good foods for prepping include non-perishable items with a long shelf life, such as canned goods, dried beans, rice, pasta, and freeze-dried meals. These foods are easy to store and provide essential nutrients needed for survival. Additionally, consider stocking up on high-energy foods like peanut butter, nuts, and granola bars, which are compact and calorie-dense. Including a variety of foods ensures a balanced diet and helps prevent food fatigue during emergencies.

How much emergency food and water should I store?

It’s recommended to store at least three days’ worth of food and water for each person in your household as a minimum. However, for more comprehensive preparedness, aim for a two-week supply.

How do I maintain my prepping supplies over time?

Maintaining your prepping supplies involves regular inspection, rotation, and replenishment. For instance, check expiration dates on food and medical supplies every few months and use the First In, First Out (FIFO) method to keep your stock fresh. Additionally, store items in a cool, dry place to extend their shelf life and protect them from pests.

I got my partner to read this and your section on ‘Are you already a prepper?’ had her converted. She’s a sticker for all of those things!

Great to see Kevin! You might also enjoy the post we did on convincing a loved one as well. Although, from the sounds of it, you might not need any help in that department.

https://thepreppingguide.com/convince-loved-ones-about-prepping/

Hey Ben, I just wanted to say thanks for writing something so well put together and easy to follow. I started with this guide a few months ago as I am an Australian prepper and it’s not very common here for people to talk about prepping, let alone to even know what it is. So cheers!

Thank you for the information. It has been very useful.

First article I read all the way through on prepping. Really informative and nicely written, thank you for sharing!